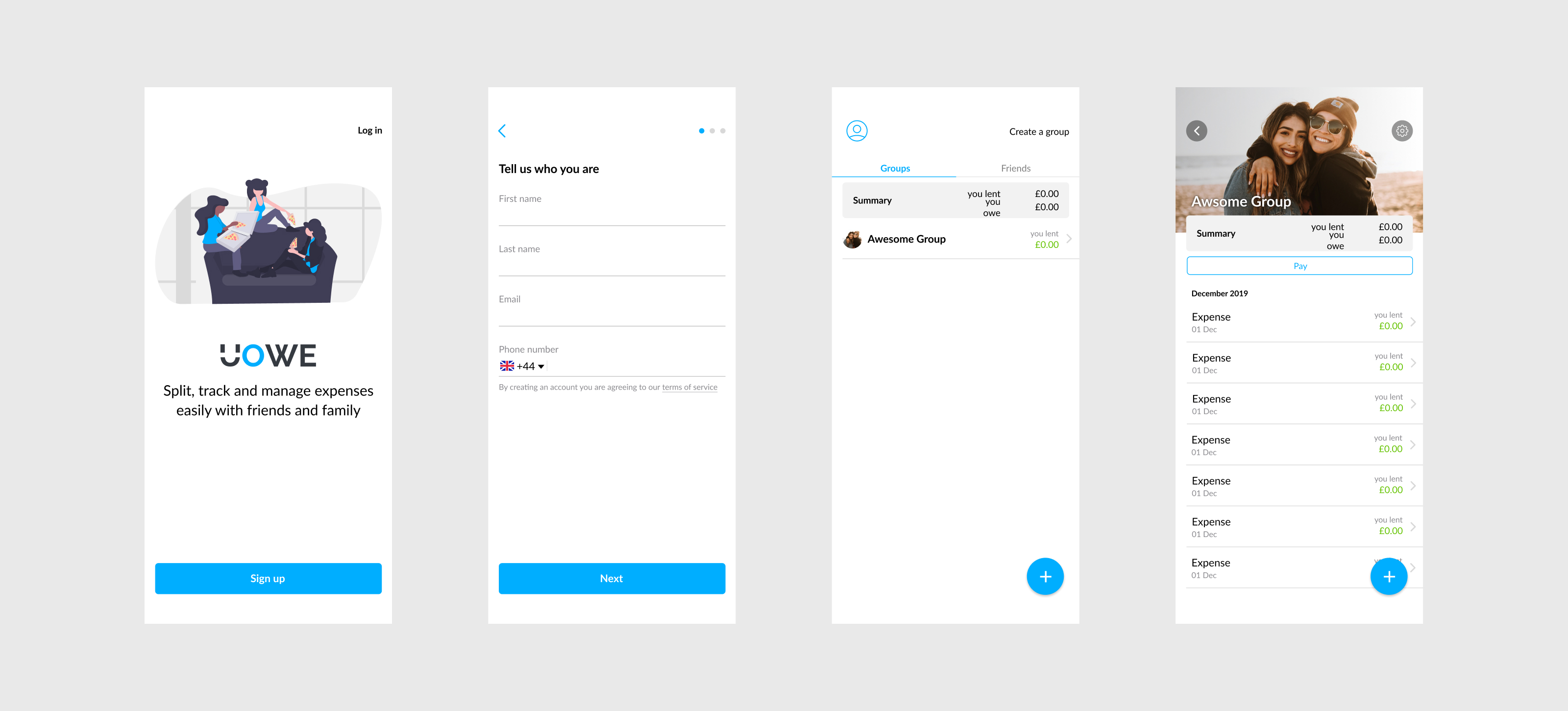

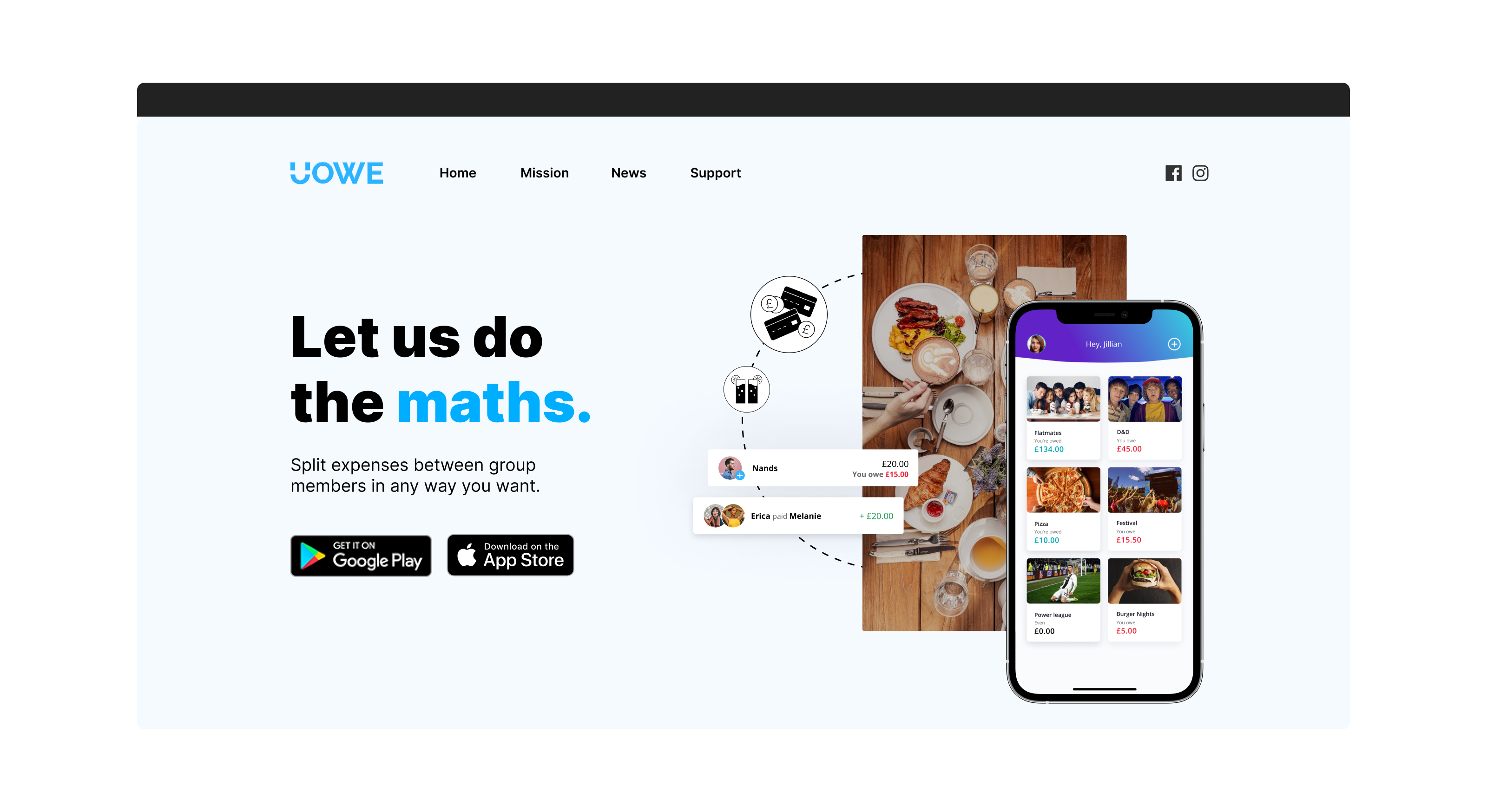

Solving an existing pain-point

Over the years, the university branch of Santander bank has been facing a recurring issue of students opening bank accounts but leaving them idle, with only 30% of students actively using their accounts after graduation. Despite taking advantage of the benefits of opening a new account, these students do little everyday banking with it.

To address this problem, the bank initiated an ambiguous greenfield project with the aim of incorporating a form of payment journey that could provide a solution. TThe objective was to increase customer acquisition and establish a long-term banking relationship.