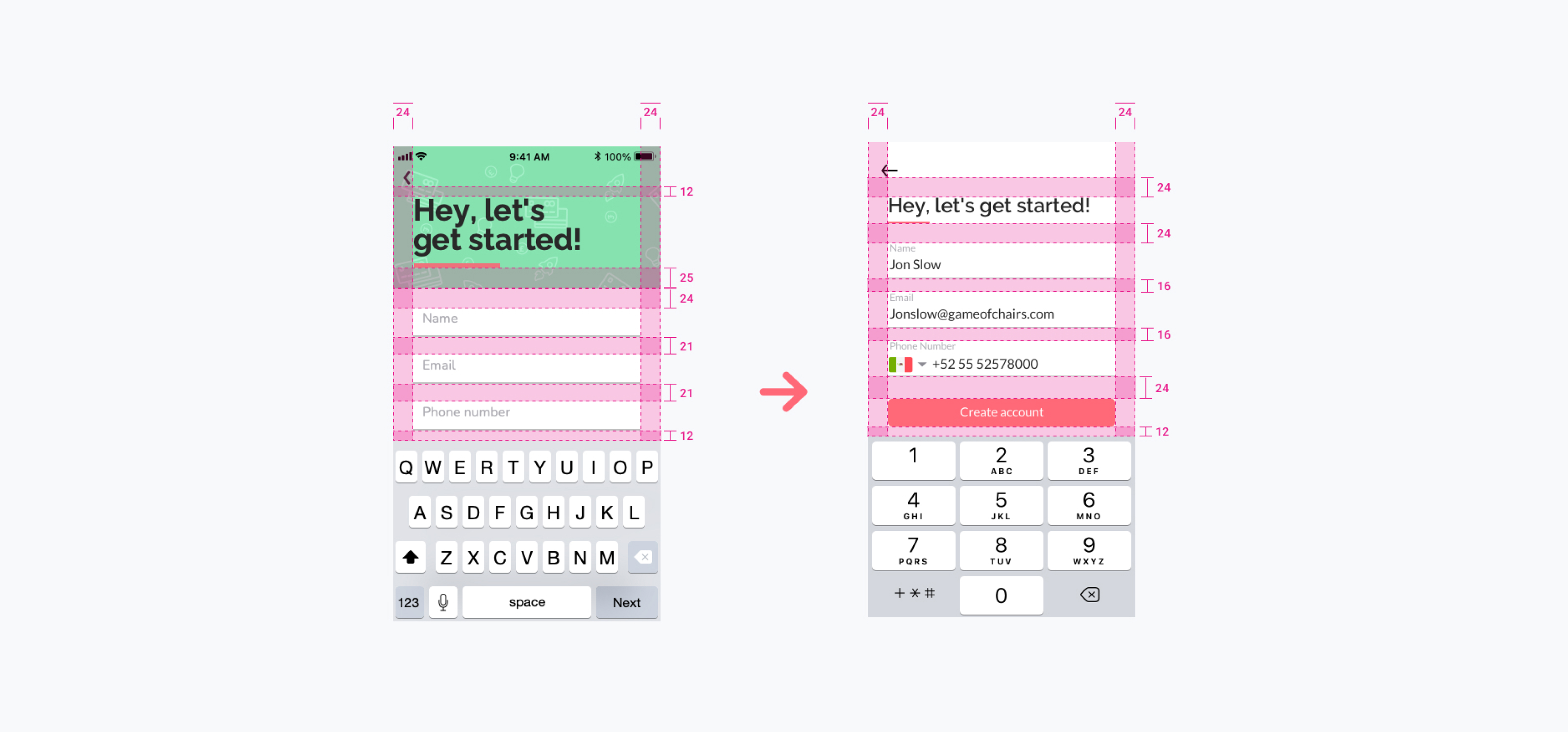

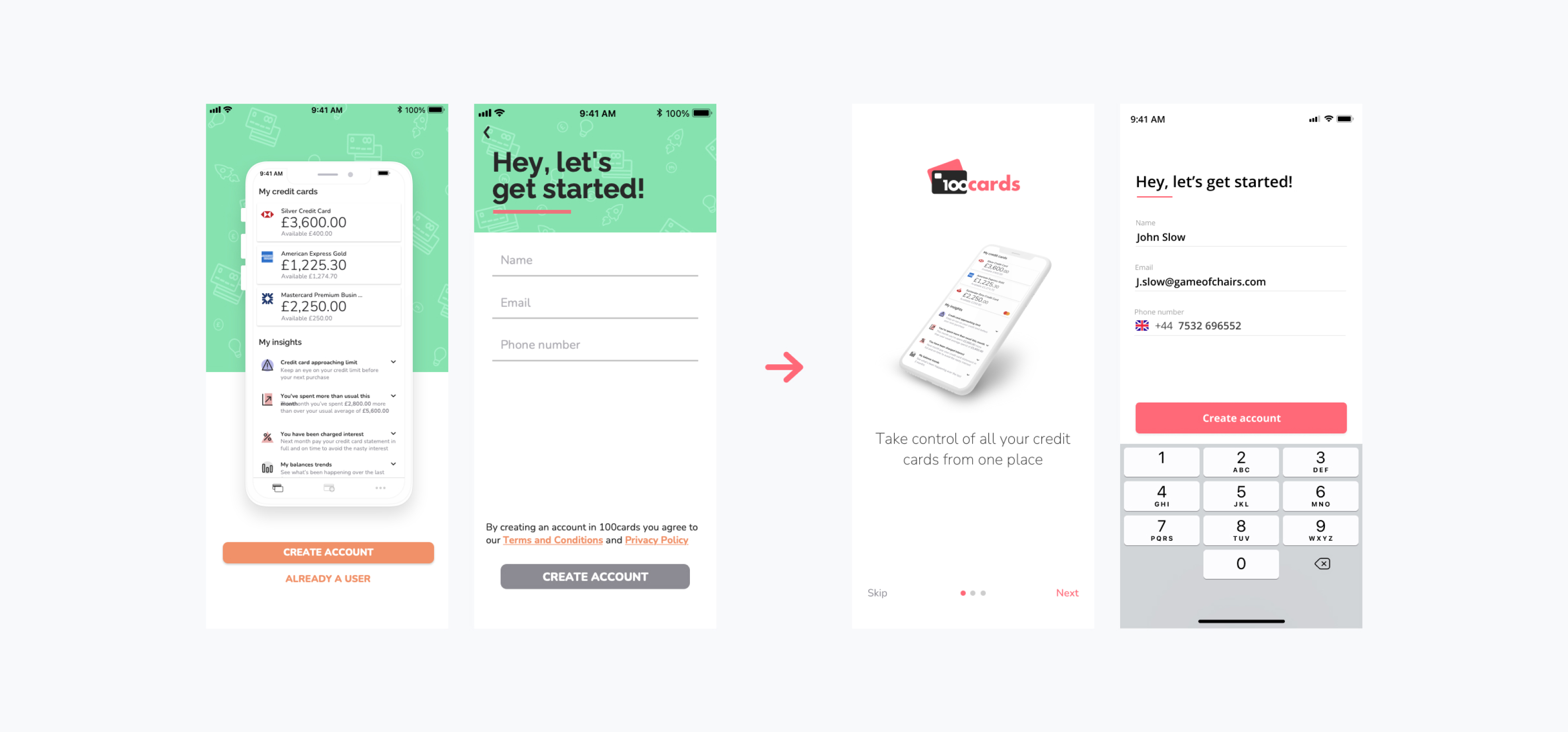

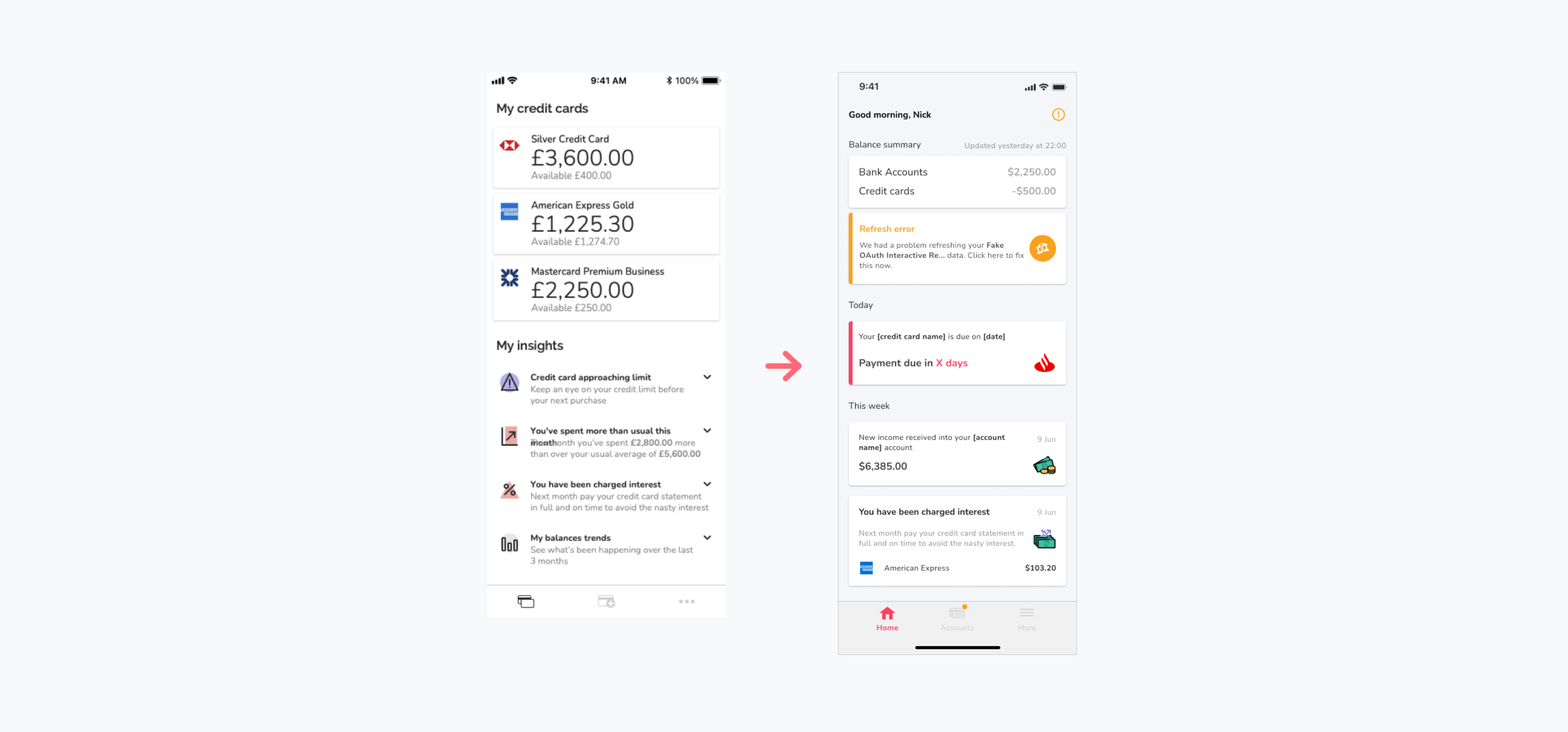

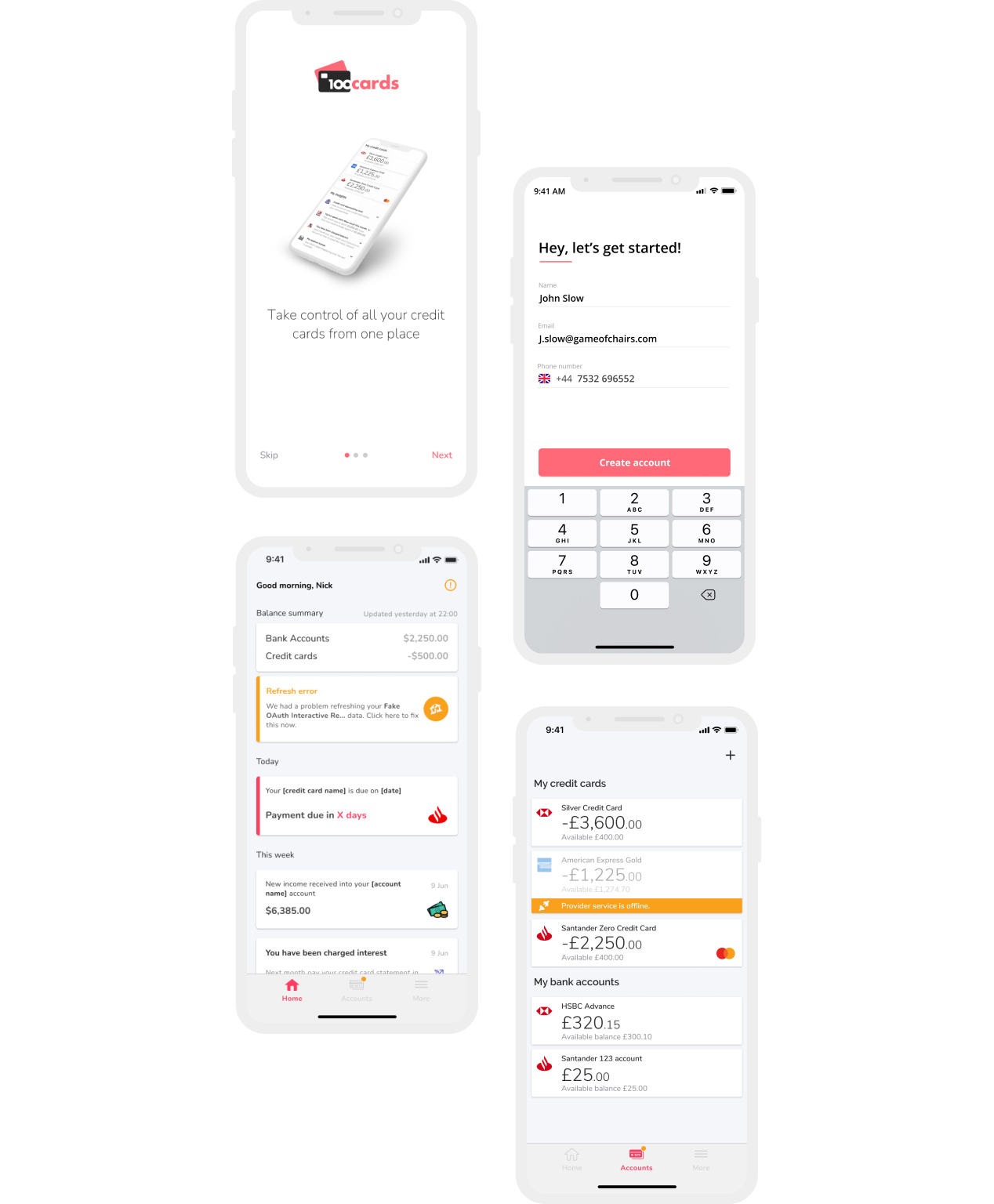

What is 100cards?

100cards is an intelligent app that consolidates all your credit cards and bank accounts in one place. By analysing your spending patterns, it assists you in minimising credit debts. With 100cards, you can effortlessly monitor your expenditures, credit limit, payment deadlines, and obtain guidance on how to improve your credit score.